Do you spend enough time looking at your business’ financial health? According to historical data from the US Bureau of Labor Statistics, around 20% of new businesses fail within the first year and around 45% within five years – and that figure has stayed remarkably consistent since the 1990s.

Pretty shocking, yes?

One of the biggest reasons these numbers are so high is that it’s far too easy to neglect the details of your business’ finances. When you’re working long hours to try to get established, taking time out to run the numbers can seem unappealing. Nevertheless, the truth is that it’s essential.

Importance of Assessing Business Financial Health

Whether you run a boutique coffee house in Singapore, a tech startup in San Francisco, or a tailor’s shop in London, you’re in business to make money, so your company’s financial health has to be a top priority.

Getting it right starts with the basics. While there are all sorts of metrics that can add color to your assessment, there are a few fundamentals that are vital to track to get a genuine picture of how well your business is performing.

You’ll want to take a multifaceted approach. There’s not one single, simple answer to the question of whether your business is financially healthy or not. When you look closely, you may find both strengths and weaknesses. But that’s a good thing, because it means you’ll have a much clearer understanding of what you need to focus on to thrive.

Aim to produce some formal data reports that give a comprehensive overview of the current situation. What will you need for those? Data and an analytics platform, of course.

Analyzing Financial Health Through Data And Analytics

If this is the first time you’ve gotten serious about looking at your business’ financial health, don’t worry. We’re going to cover six tasks that will help you understand your business’s finances inside and out.

Identify Crucial Financial Indicators And Trends

Remember we said it was important to focus on the basics? We’re not kidding. If you’ve always left anything to do with the numbers up to your accountant, it’s time to grab a coffee and get your head around the accounts.

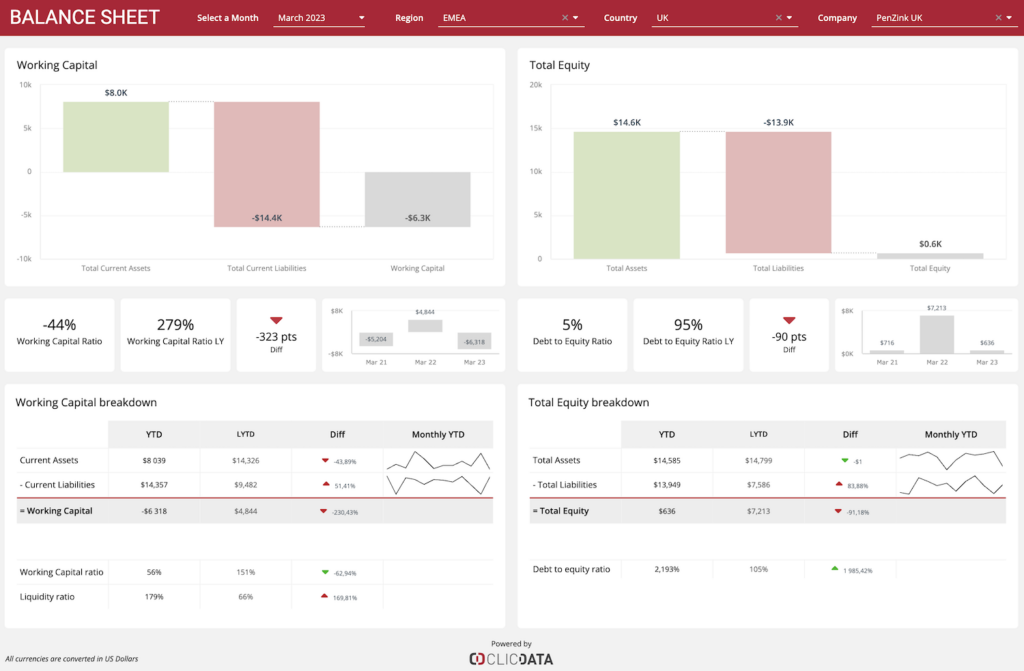

Specifically, take a look at the balance sheet. It lists the business’ assets (everything it owns) and liabilities (everything it owes). It also includes a line for total equity; calculate this by subtracting the total liabilities line from the total assets line. Essentially, it’s a measure of the business’s net worth. If this is positive, you’re off to a good start.

Ideally, you want to track these figures over time, because identifying trends in the data is important. Ask yourself questions such as:

- Is the total debt figure going up or down?

- Is the total equity figure growing or shrinking?

- How do these figures compare to last year’s?

Once you’ve done this, you’ll have given yourself a good grounding in the fundamentals. The next step is one of the most important of all: an honest look at your cashflow.

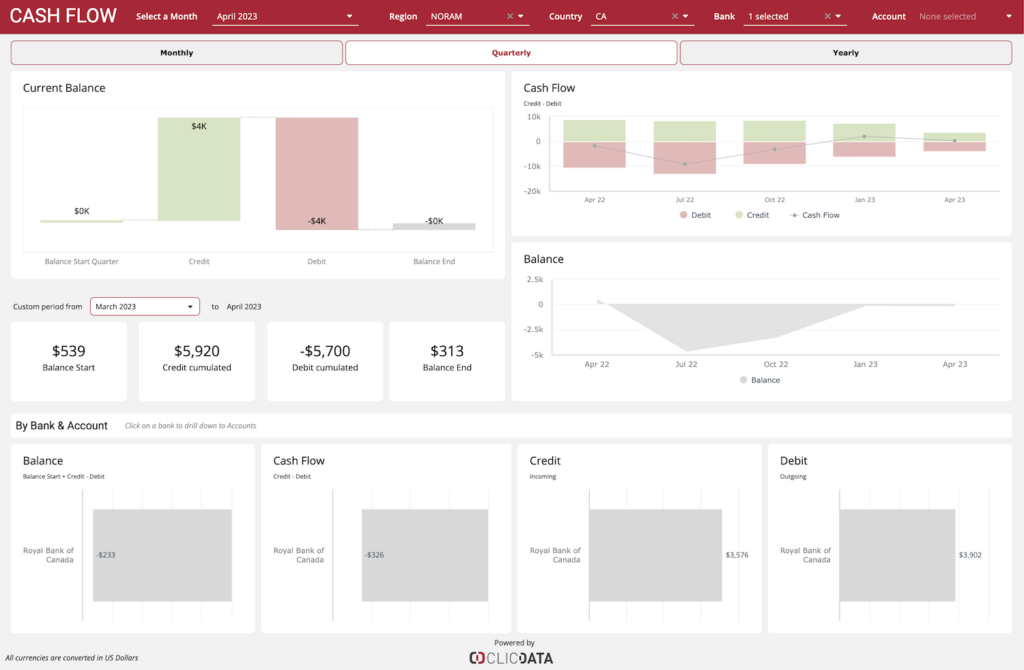

Tracking, Projecting, And Optimizing Cashflow

Cashflow problems can sink an otherwise viable small business frighteningly quickly. Unlike larger organizations, smaller companies rarely have a large pile of liquid cash available to them to meet their expenses. Generally speaking, they will need to pay these costs out of their regular income.

One of the dangers to watch out for is that while many small businesses work on a 30-day payment cycle, some larger businesses prefer to use a longer one: 60 days is not uncommon, and it can even stretch to 90 days. So if you run a small business and land a big client, this is something to be aware of in advance. Forewarned is forearmed.

If multiple clients are late in paying—or even just one large client is—it can precipitate a crisis, so keeping on top of your cash flow is essential. The best way to do this is to implement a billing system that uses specialized software to help you monitor the income that’s due to you.

These tools can track the time spent on projects and generate invoices automatically. They also often offer payment integrations to help simplify the payment process for your customers. But the biggest boon is that they will also track every penny you are owed over time, making it much easier to handle your cash flow situation.

Evaluate Revenue, Expenses, And Profit Potential

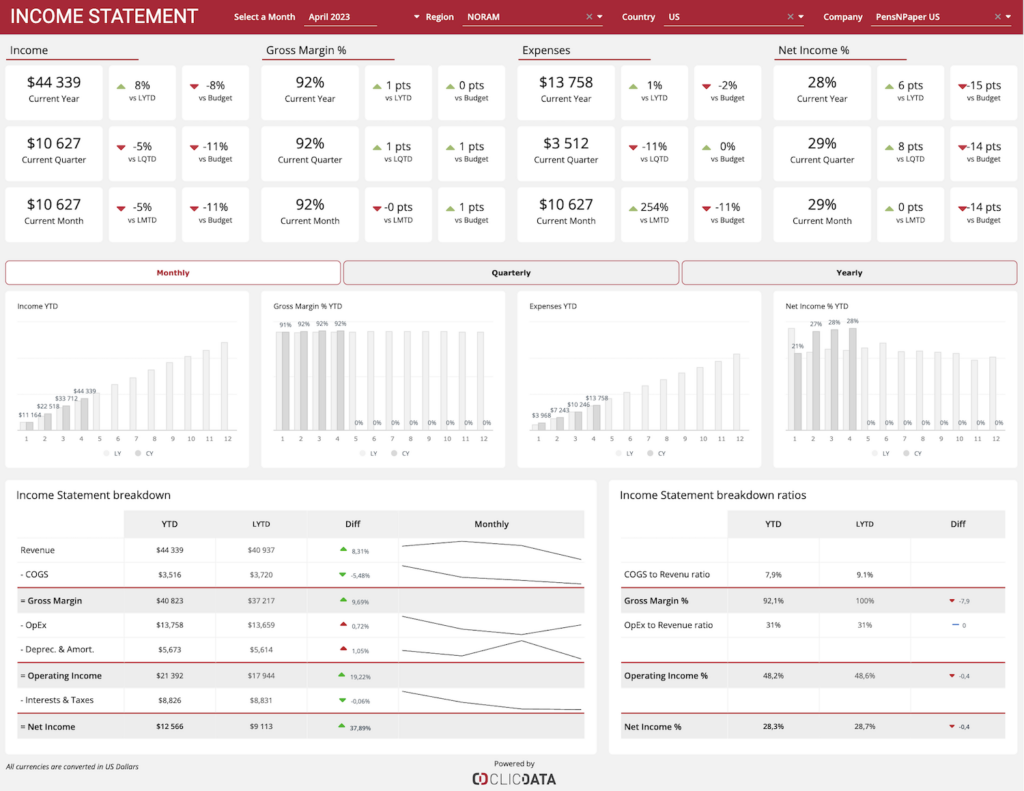

The next thing to consider is how much money is coming in and going out over the medium term. For this, it’s time to head back to the accounts and explore the income statement. It will tell you exactly how much money is going through your business in each annual period.

At this point, it can also be instructive to get into more detailed metrics that you won’t find in the accounts, but that can give you an idea of whether you can improve your current strategy. For instance, tracking your customer acquisition cost or customer churn can be very illuminating.

The harsh reality is that some customers are worth more to your business than others. To maximize your profit potential, focus on attracting more of the valuable type of customer.

Now, this isn’t to say that you should deliberately try to drive people away, but there are steps you can take to reduce the cost of attracting profitable customers. These include:

- Prioritizing a specific target audience

- Reducing the length of the customer journey

- Retargeting satisfied customers

Over time, working these elements into your strategy can give your business’ profitability a big boost.

Create Budget Forecasting And Result Comparisons

With a solid understanding of your income and expenses, you can build a budget forecast. Select a forecast period and project your regular incomings and outgoings that far ahead.

This should be relatively straightforward if you’re using online invoicing software and tracking your expenses using payment apps, since these handy tools make sure you’ll have all the relevant data to hand.

Do remember, though, that the further out you forecast, the less accurate the figures are likely to be. For most small business owners just getting to grips with the numbers, 24 months is plenty to begin with.

If your business is affected by seasonality, remember to factor that in. Many retail and ecommerce stores make a large percentage of their total yearly income around major festivals, such as Christmas or Eid. On the other hand, if you run an ice cream parlor near Malibu Beach, your income probably peaks in July or August every year.

Revisit your forecasts regularly to check how closely they match reality. You may find that you need to do some tweaking.

Predict Potential Risks And Opportunities For Growth

Change is the only certainty in life, so it’s vital to be ready for whatever the future throws at you. The financial health of your business doesn’t just depend on what you do; events, competitors, new technology—they all have an impact too.

Try to find ways of turning this to your advantage. First, it’s crucial to consider any potential risks on the horizon. What would you do if a new competitor started muscling in on your regular clientele, for example? How would it affect your forecasts? Make sure you have a plan B in place to cover every eventuality.

On a more cheerful note, now that you’re getting to grips with the figures, you’re in a great position to consider new opportunities. Using data-driven lead generation techniques, you may well find doors opening to you that were previously closed.

Compare Financial Metrics Against Competitors

Finally, keeping an eye on the competition is a good idea. How do you match up? Benchmarking your business’s performance against others in the same sector is a healthy habit and good business practice.If you run your business online, you’re in luck. You can use competitor analysis tools such as SEMrush or Ahrefs to compare digital metrics and establish how well you’re doing in relative terms.

Unless your competitors are all publicly listed companies, you won’t know the details of their finances, of course—but you can deduce a lot from their online performance.

If you run a more traditional small business, don’t fret. It’s still possible to create your own competitor analysis. What you need to do first is find your competitors. You can do this by going for a drive around your local area or carrying out some research on local social sites such as Facebook or Nextdoor.

Then, focus on metrics that function as useful proxies for income. In a retail store or eatery, that could mean footfall or the number of tables occupied at different times of day. You’ll need to get creative, but it can be well worth it. You may discover some new ideas to try—or learn about what not to do.

Key Takeaways

Getting to grips with your business’ financial health is one of the smartest things you’ll ever do. Too many small businesses fail gradually, then suddenly all at once, because the owner took their eye off the financial ball.

It doesn’t have to be this way. If you take the steps outlined here and keep on fine-tuning your strategy, there’s no reason why your business shouldn’t be one of the success stories. Good luck!