ClicData for Financial Services

ClicData is proud to support financial services providers in leveraging the power of data to make informed decisions and drive business growth.

Empowering Financial Services with Data-Driven Insights

In the fast-paced financial services industry, having access to accurate and timely data is crucial. To stay competitive, businesses need to make data-driven decisions that enable them to optimize operations, reduce risk, and capitalize on market opportunities. At ClicData, we understand the unique challenges faced by financial services providers, and we're proud to offer a powerful and flexible business intelligence platform that caters to their specific needs.

We can help you...

Global Investment Firm

Challenge: The firm needed a way to streamline the data aggregation and reporting process from multiple sources and quickly make sense of large volumes of data.

Solution: By implementing ClicData, the firm consolidated their data into a single platform and created interactive dashboards to visualize and analyze data in real-time.

Results: Improved decision-making, increased efficiency, and better risk management.

Regional Bank

Challenge: The bank wanted to optimize branch performance and identify growth opportunities in local markets.

Solution: Using ClicData, they built custom dashboards to monitor key performance indicators (KPIs) and track trends across their branches.

Results: Data-driven insights led to targeted marketing strategies, increased loan approvals, and enhanced customer satisfaction.

Insurance Provider

Challenge: The insurance company needed to analyze claims data and identify trends to reduce costs and improve customer service.

Solution: ClicData's platform allowed them to visualize and analyze claims data, identifying patterns and anomalies.

Results: Faster claims processing, reduced operational costs, and improved customer retention rates.

Financial Advisory Firm

Challenge: The firm needed to monitor and manage the performance of their clients' portfolios efficiently.

Solution: ClicData provided a comprehensive view of their clients' assets through customizable dashboards, enabling more effective portfolio management.

Results: Increased client satisfaction, better-informed investment decisions, and enhanced risk management.

Key Performance Indicators and Metrics

-

Revenue

The amount of revenue generated from financial products and services, such as loans, investments, and insurance.

-

Net interest margin

The difference between the interest income generated by the business and the interest paid to customers or investors.

-

Assets under management (AUM)

The total value of assets that the business manages for clients, such as mutual funds or investment portfolios.

-

Return on assets (ROA)

The percentage of return generated by the business on its total assets.

-

Efficiency ratio

The ratio of expenses to revenue, which measures the efficiency of the business in managing its costs.

-

Loan loss reserve ratio

The percentage of loans that are expected to default, and the amount of money set aside by the business to cover potential losses.

-

Customer satisfaction

The level of satisfaction customers experience with the financial products and services offered by the business.

-

Regulatory compliance

The level of adherence to regulations and laws governing the financial services industry.

-

Investment performance

The performance of investment products, such as mutual funds or exchange-traded funds (ETFs), relative to benchmark indexes.

-

Fee income

The amount of income generated from fees charged for financial products and services, such as account maintenance fees or transaction fees.

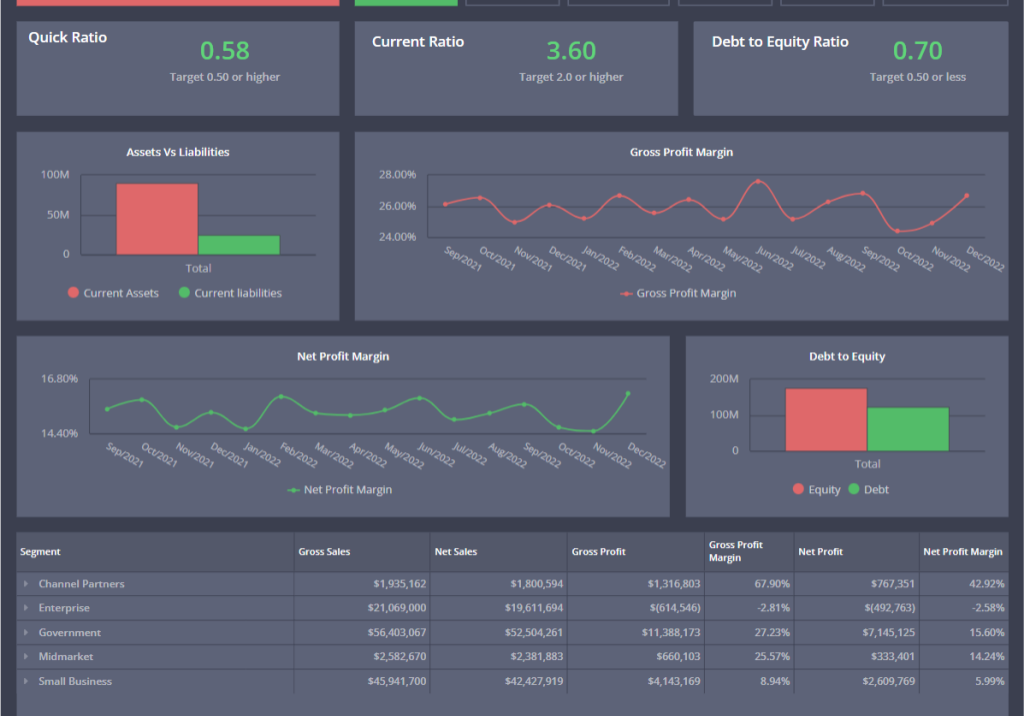

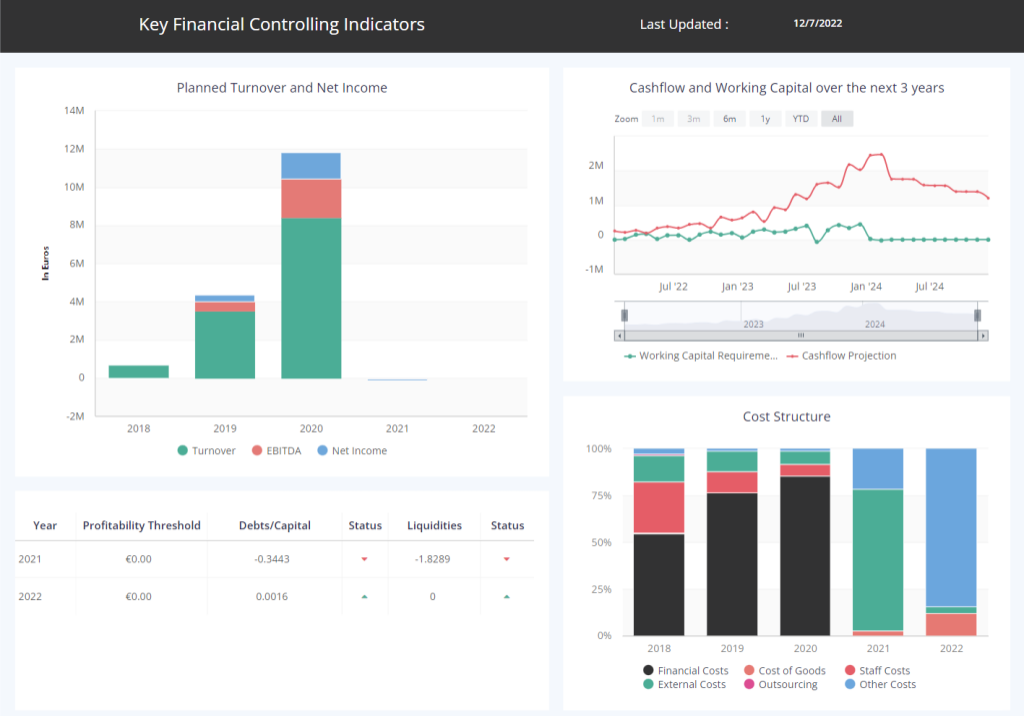

Financial Services Dashboards

Resources

7 Data Challenges in Financial Services and How to Overcome Them with BI

On average, financial companies analyze just 24 percent of big data collected. That means 76 percent of potentially valuable data plus the resources used to…

Don’t Wait For Your Annual Financials to Track Your Financial KPIs

Maybe you’re working on closing your 2020 financials at this very moment, gathering all relevant information with your accounting team. If so, it’s the perfect…

Consolidate Multiple Xero Accounts in an Insightful Report

In this webinar, learn how to connect, combine multiple Xero accounts data and build custom dashboards. On…